TTB

Brewer's Notices / Permits

Any alcoholic beverage producer will need TTB approval to operate

Any company that wishes to commercially produce, package, blend, distribute, or import alcoholic beverages in the United States will need to obtain approval from TTB before beginning such activities. For alcoholic beverage producers, it is typically best to file to register at TTB shortly after signing a lease agreement (or purchasing a space for the company).

Federal Basic Permit Required for MOST alcoholic beverage producers and dealers, but not brewers Federal regulations requires that a person that wishes produce, blend, and/or package distilled spirits (i.e., operate a “distilled spirits plant”) or wine products (i.e., operate a “bonded winery”) (27 CFR 1.21), engage in the business of importing into the United States distilled spirits, wine, or malt beverages (i.e., operate an import company) (27 CFR 1.20), or engage in the business of purchasing for resale at wholesale distilled spirits, wine, or malt beverage products (i.e., operate a wholesaler) (27 CFR 1.22), must do so pursuant to a federal basic permit. Notably, a brewery is not required to maintain a federal basic permit.

Commercial brewers are required to obtain a federal brewer’s notice

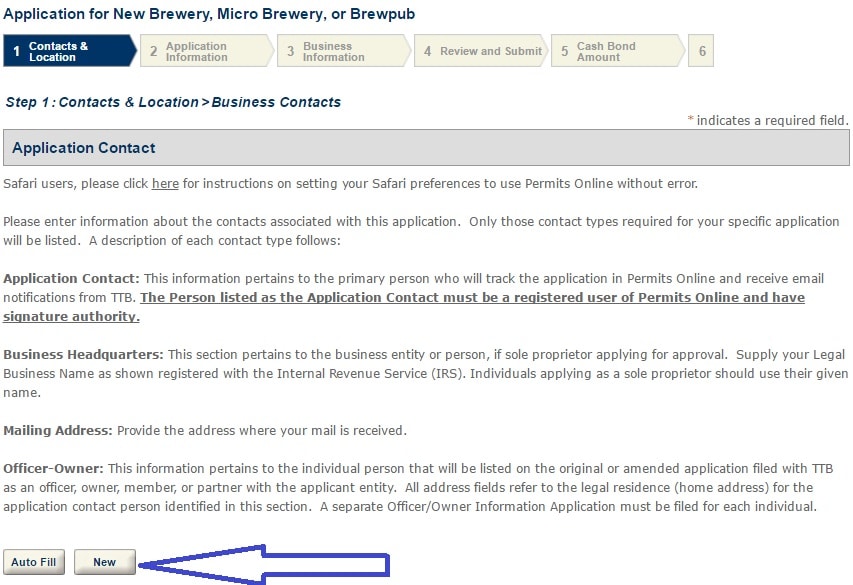

A person wishing to operate a brewery is required to give notice to TTB of their intent to operate a commercial brewery (CFR 25.61). In giving notice, the brewer must disclose information about the owners of the brewery, the company that will operate the brewery, the sources of funding for the brewery, the space and equipment that will be used to brew and package the beer. Giving notice is an involved process that takes months (see the average processing times here) and almost universally requires back and forth to meet TTB’s current requirements (which change from time to time).

After issuance, brewers, distillers, wineries, distributors, and importers are required to maintain the permits and notices

After approval, permittees and notice holders are required to notify TTB in the following situations (this is non-exhaustive):

- Addition or deletion of an owner or officer;

- Adding or removing power of attorney or signing authority;

- Changes to the premises (e.g., adding equipment, moving walls);

- Adding another operation (e.g., distilling, winemaking, non-alcoholic beverage production)

- Adding a tenant in an alternating proprietorship;

- Moving locations and changing addresses;

- Trade name changes

Most changes do not require the issuance of a new permit or notice. A new permit or notice is required, however, when there is a change in the entity that will be running a business at the premises going forward (i.e., Company A sells its assets to Company B, and Company B will operate a new operation in the space going forward). Most changes are required to be disclosed to TTB within 30 days of the change.

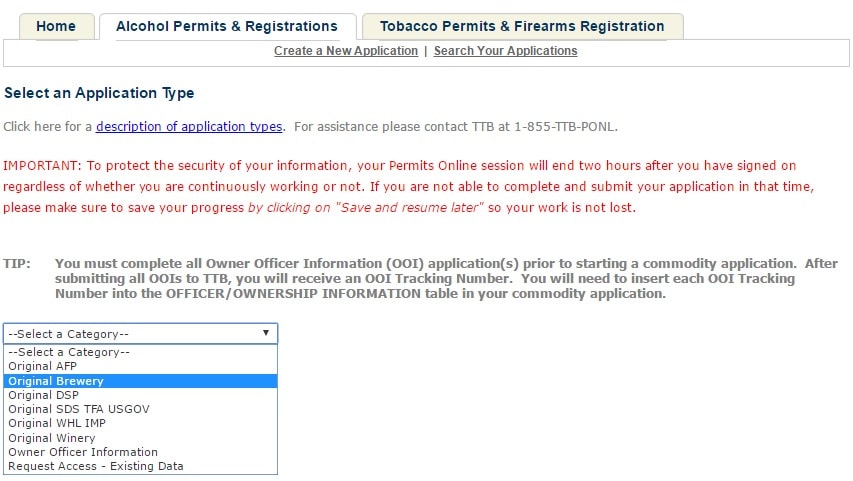

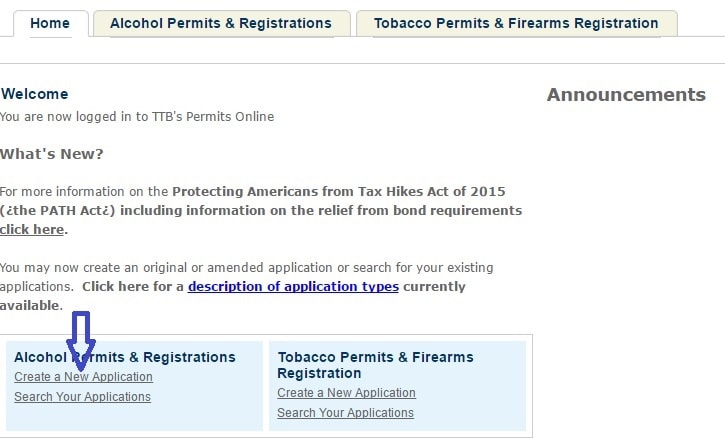

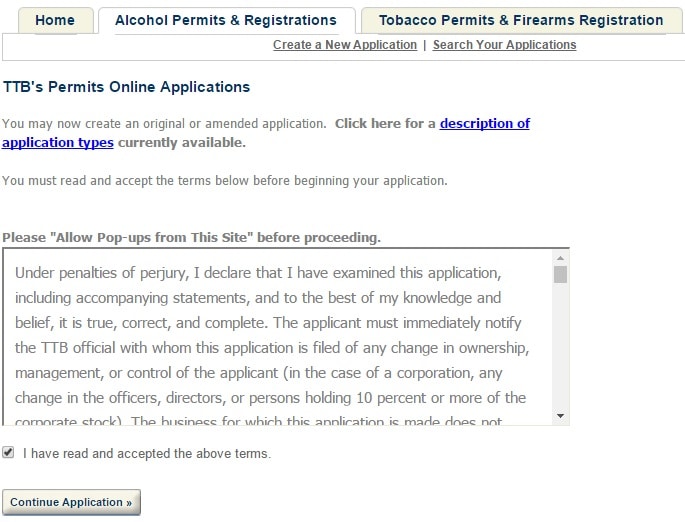

How to Start a TTB Brewer’s Notice Application in Permits Online

We have seen some confusion out there about how to initiate a brewer’s notice application. Here is an overview of the steps involved, each of the sections below can be expanded and images enlarged.

Since TTB’s processing time for Brewer’s Notices tends to be on the longer side (here is the current processing time for Brewer’s Notices), we recommend trying to have your application as complete as possible before submitting. To help speed things along, you may want to have someone who has completed the process before (especially someone with recent knowledge of the process, since it has changed significantly this year) review your application before submitting it.

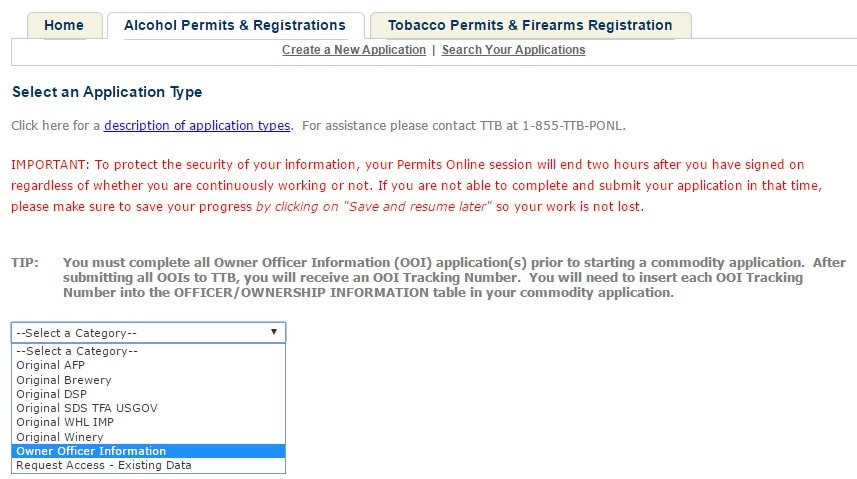

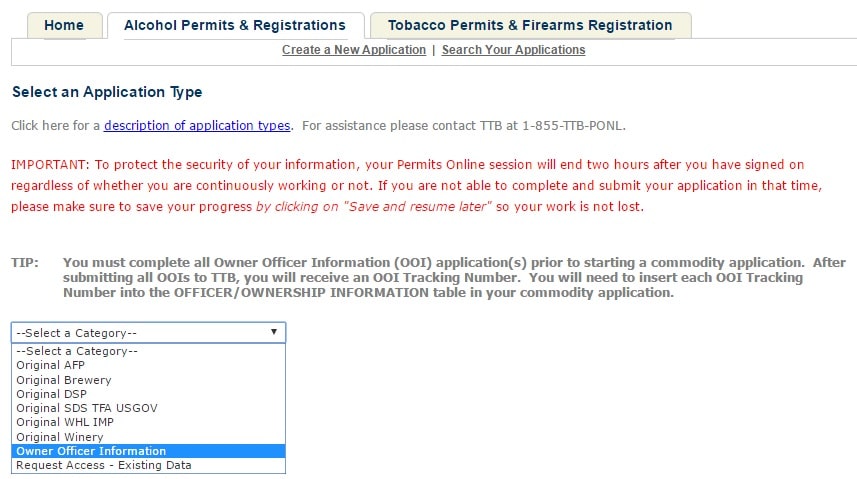

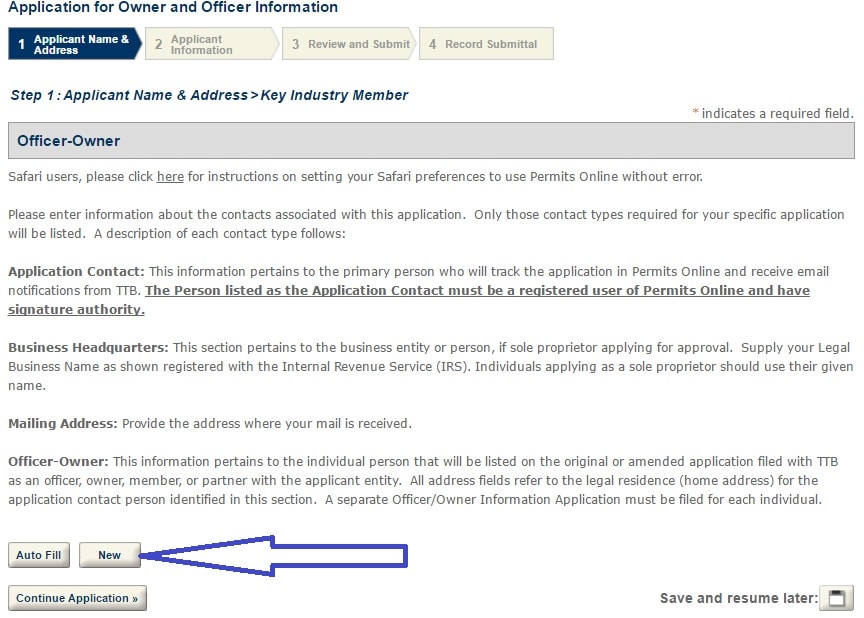

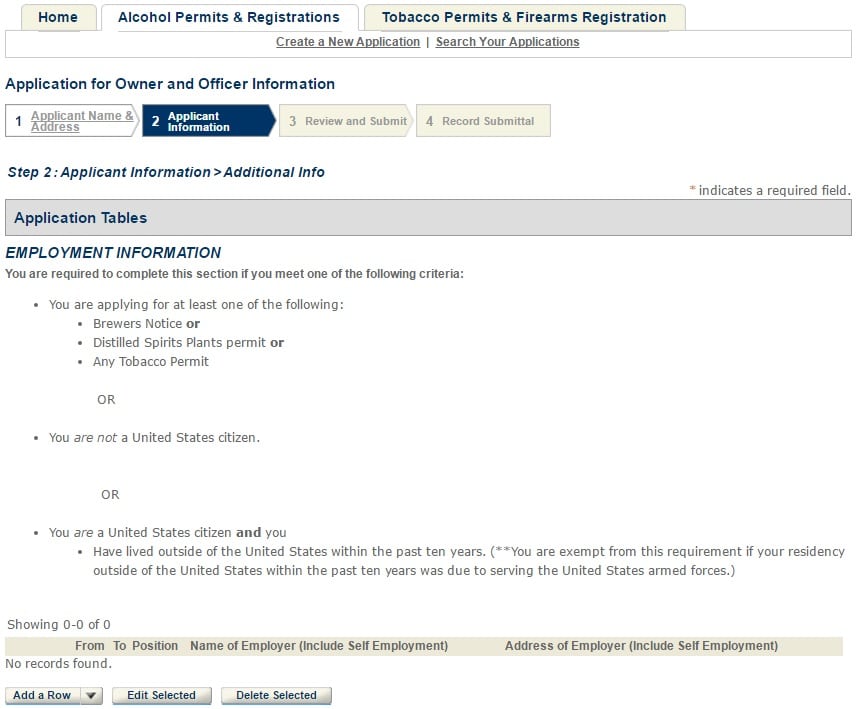

How to Complete the TTB’s Owner Officer Information Questionnaire in Permits Online

This guide walks you through how to complete an OOI through TTB’s Permits Online system. Each of the sections below can be expanded and images enlarged.

Who must complete an OOI?

TTB requires that every person that will be listed as an officer, director, or stockholder of more than 10% of a corporation; a member or managing member of an LLC; a limited or general partner in a partnership; or a sole proprietor complete an Owner Officer Information application (OOI).

Create a Permits Online Account (or login to your existing account)

Tip 1: You have a choice of having each owner/officer create their own PermitsOnline account, or sharing a single login for each owner/officer to complete their OOI. One benefit to filing all OOI’s under a single account is that you will have all of the OOI tracking numbers handy when you need to plug them into your federal basic permit application (i.e., Brewer’s Notice, Bonded Winery, Distilled Spirits Plant, Wholesaler/Importer, etc.).

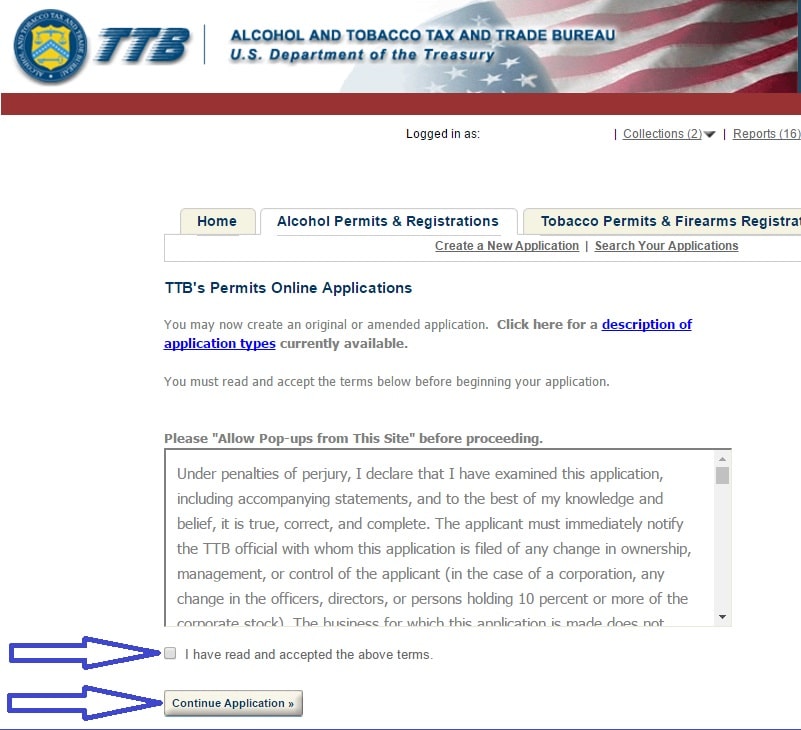

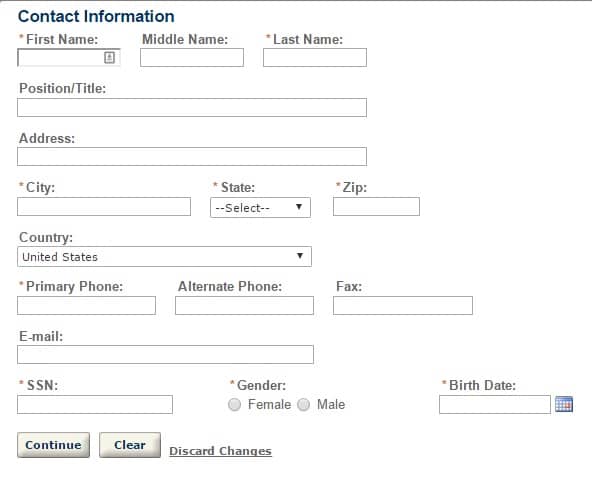

Complete the “Contact Information” section and hit “Continue Application”

Tip: If an owner/officer does not have a social security number (i.e., is not a US national), you can simply put in all zeros for that section.

Tip: Email address is not required, but you should include it if you want to receive updates from TTB regarding your application by email.

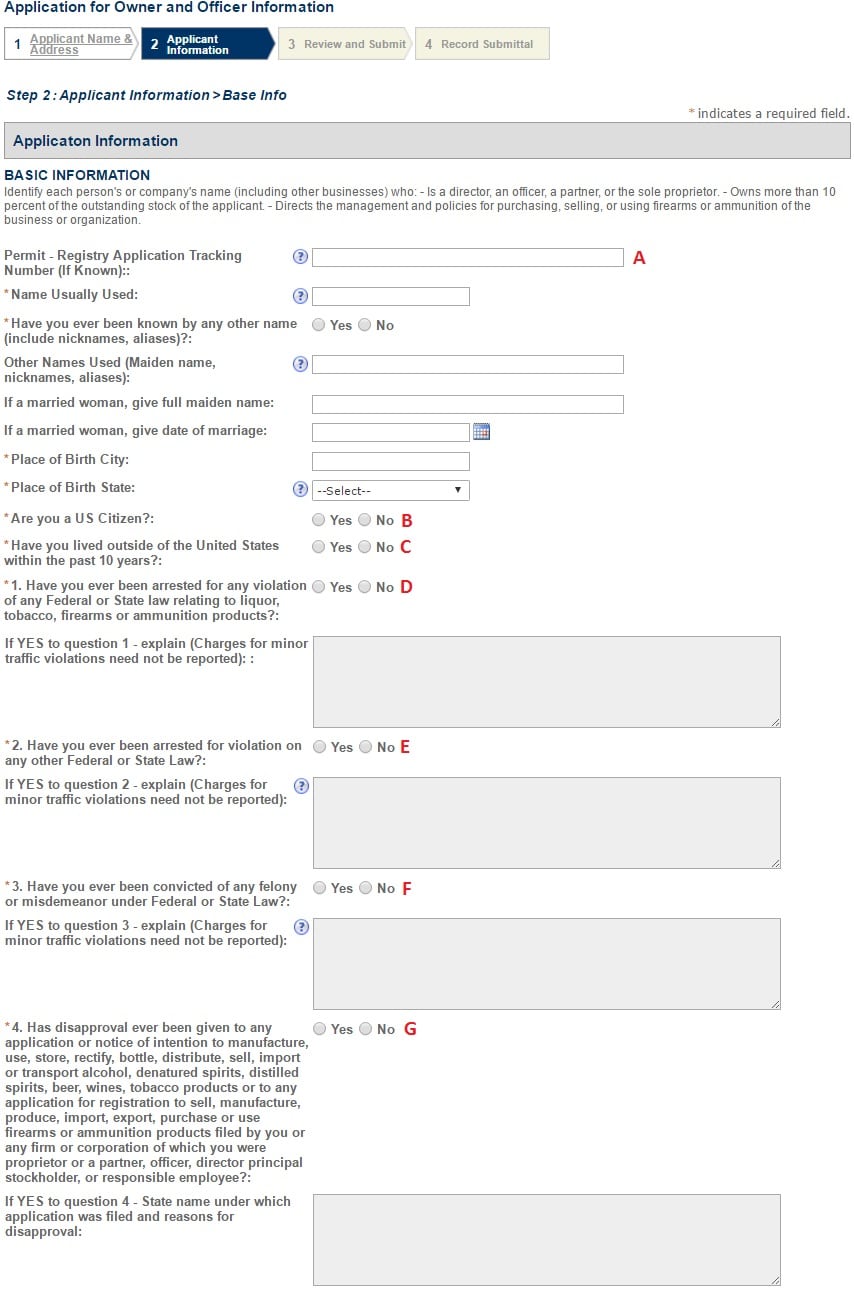

Complete the “Application Information: Basic Information” section and hit “Continue Application”

Tip: Don’t worry about including the Registry Application Tracking Number (A), unless you already submitted your permit application, and are trying to add another OOI.

Tip: Your answers regarding your citizenship (B) and living outside the US in the past 10 years (C) will determine whether you are required to complete later, supplemental sections

Tip: Regarding liquor related arrests (D), include DUI’s, public intoxication. Also, I would recommend including the final disposition for the arrest (e.g., Pleaded guilty to lesser offense, 1 Year probation, etc., this applies to D-F).

Tip: Regarding disapprovals for sell/manufacture/produce/etc. (G), this relates to prior applications for TTB permits, state producer or retail.

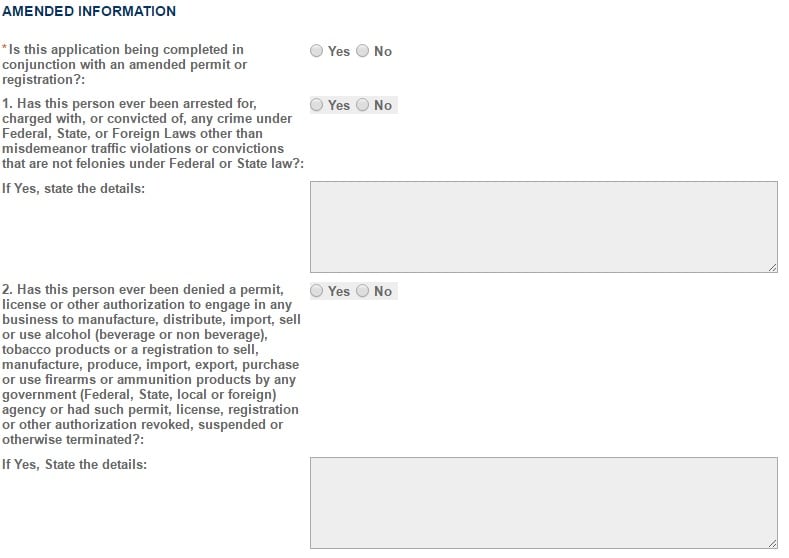

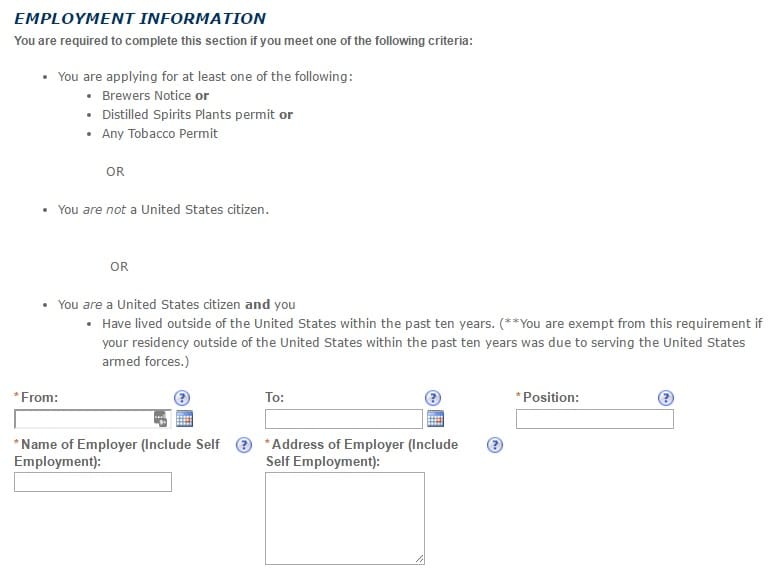

Only applicable if you are applying for a brewer’s notice, distilled spirits plant (distillery), or tobacco plant permit, (2) you are not a US citizen, or (3) you have lived outside the US in the last 10 years. Note:

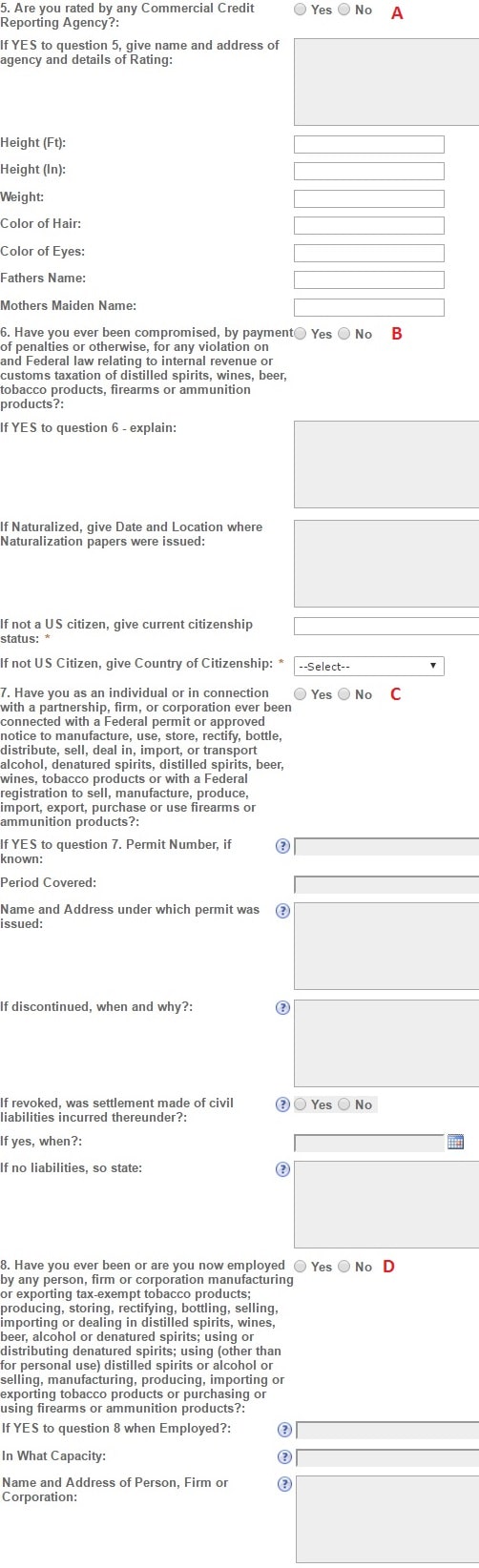

Tip: TTB is in the process of eliminating question 5 (including height, weight, hair and eye color, father’s and mother’s names). Commercial Credit Reporting Agencies (A) relate to agencies that provide credit report numbers, such as Equifax, Experience, Dun & Bradstreet. It is not required that you have a credit report run to provide this information to TTB.

Tip: Penalties for failing to taxes (B) only relates to penalties for failing to pay IRS taxes or excise taxes.

Tip: Connection to a Federal permit (C) only relates to an ownership stake in a TTB permit relating to alcohol or tobacco. This does not relate to being employed by a permittee, and is not related to retail liquor permits. This should not affect your ability to get a TTB permit with a different permittee.

Tip: Employed by a Federal permittee (D) only relates to employment by a TTB permittee relating to alcohol or tobacco (including as a server, brewer, etc.). This does not relate to being employed by a permittee, and is not related to retail liquor permits. This should not affect your ability to get a TTB permit with a different permittee.

If the owner/officer is a citizen and has not lived outside the US in the past 10 years, this section is only required for beer/wine/spirits producer permits.

Tip: First, close the pop up window that asks for your residence. Click “Add a row,” and select the number of rows corresponding to the number of residences you have had in the past 5 years (unless you are not a US citizen or lived outside the US in the past 10 years, then choose 10 years).

Tip: If you don’t know exact dates, use your best estimates. You should account for any gaps (e.g., unemployed, student).

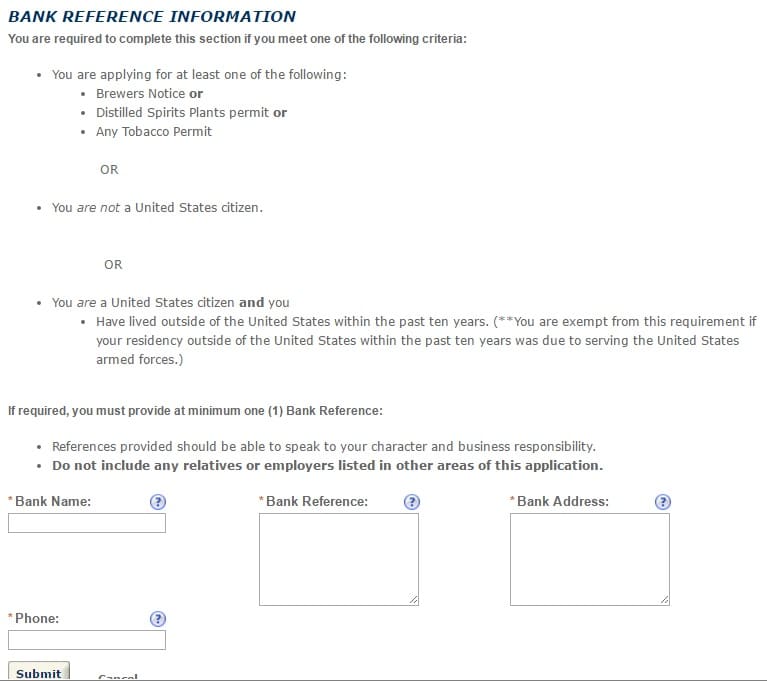

Only need to provide 1 at max. If the owner/officer is a citizen and has not lived outside the US in the past 10 years, this section is only required for beer/wine/spirits producer permits.

Tip: If you don’t know the name of your representative at the bank, you can just put Bank Manager.

Tip: If you bank at a national/regional bank, put the address for the branch closest to your business.

If required, must provide 4 references. Required if the owner/officer is not a citizen, has lived outside the US in the past 10 years, or if the application is for a beer/wine/spirits producer permit.

Tip: You really only need to provide the reference’s name, home address (really any address), and their home phone.

Note: I believe the character references are being eliminated from this form in the near future.

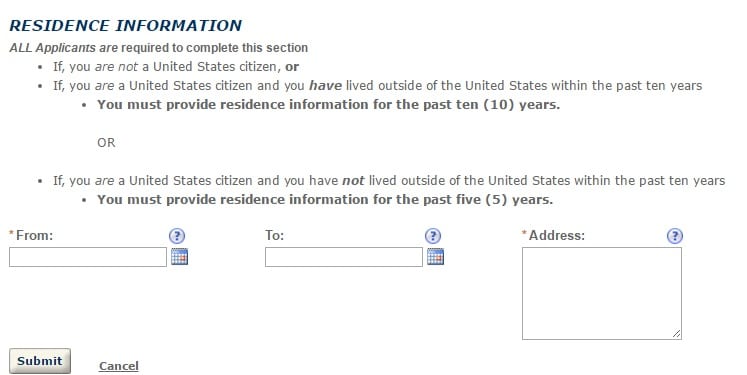

Required for all applicants.

Click “Add a row,” and select the number of rows corresponding to the number of residences you have had in the past 5 years (unless you are not a US citizen or lived outside the US in the past 10 years, then choose 10 years).

Tip: For your current address, leave the “To:” field blank.

Now all that is left is to hit continue, review the information, and (if correct), hit continue one last time.

Your OOI is now submitted.

Send your OOI tracking number to whoever if submitting your permit application. They will need to plug the tracking number into the permit application.